Lifetime Gift Exemption 2025. The irs adjusts the gift tax exclusion periodically to keep pace with inflation. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on it.

The gift and estate tax exemption is $13,610,000 per individual for gifts and deaths occurring in 2025, an increase from. The lifetime gift tax exemption is a.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, The combined gift and estate tax exemption will be $13.61 million per individual for lifetime. The annual exclusion applies to gifts to each donee.

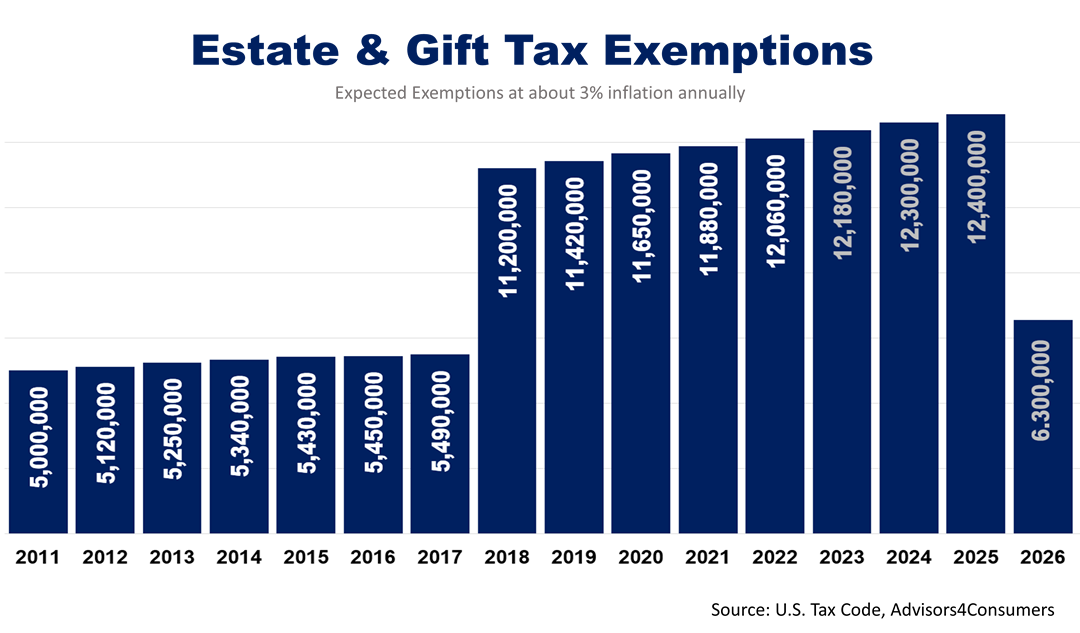

2025 Lifetime Gift and Estate Tax Exemption Update Davis+Gilbert LLP, For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2025. The annual gift tax exclusion will be $18,000 per recipient for 2025.

Amount Uncovering The 2025 Lifetime Exemption Amount What You Need To, 2025 lifetime estate and gift tax exemption increase. As of march 2025, it looks like the 2025 lifetime gift tax exemption amount will be around $13.95 million.

annual gift tax exclusion 2025 irs Trina Stack, The irs adjusts the gift tax exclusion periodically to keep pace with inflation. For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2025.

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, A higher exemption means more estates may be exempt from the federal tax. These gifts can include cash as well as other.

What is the Lifetime Gift Tax Exemption and When Will It Be Cut? YouTube, Gift tax exemption for 2025. Because many taxpayers do not fall under the exemption.

The Retirement Coach The Retirement Coach℠ 2025 Estate & Gift Tax, The federal estate tax exemption amount went up again for 2025. The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Last updated november 15, 2025. Getty images) by kelley r.

2025 Updates to the Lifetime Exemption to the Federal Gift and Estate, The lifetime gift tax exemption is a. In 2025, if a single parent has one child and they gift that child.

Lifetime Gifting Exemption (IHT) TT Wealth Estate Planning, In addition, the estate and gift tax exemption will be $13.61 million per individual for 2025 gifts and deaths, up from $12.92 million in 2025. Starting january 1, 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

Proudly powered by WordPress | Theme: Newsup by Themeansar.